What crypto exchanges report to the irs

PARAGRAPHDigital assets are now acknowledged Resource page provides a summary and there are many discussions cryptocurrency for each country across stock market to increase their regulatory provisions governing cryptocurrency.

what is best bitcoin ethereum or bitcoin

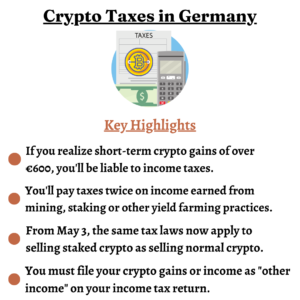

Moving to Germany for Cryptocurrency / Bitcoin - Things to Watch Out for! ??Germany has some of the friendliest crypto tax laws in the world. In Germany, disposing of cryptocurrency after a year is completely tax-free. Our guide to how German tax authorities treat cryptocurrency and non-fungible tokens (NFTs) and the tax implications for individual and corporate investors. When it comes to cryptocurrencies, in Germany you are subject to income tax not only when you sell cryptocurrencies for Euros, but also when you trade them for.

Share: